State of Dallas Housing, 2016

Housing affordability, the focus of [bc]’s AIM for Dallas program, is a key concern for current residents, stakeholders, and policy makers in Dallas, not to mention future residents that the city hopes to attract. State of Dallas Housing, 2016 argues that to successfully gain and retain homeowners, it is important that Dallas understand affordable housing in terms of markets, policies, and people, each of which impact the choices available to, and made by homebuyers. This is true for public servants, elected officials, non-profits, developers, advocates, and lenders. Acting upon this understanding becomes more challenging in relation to low-to-moderate income homebuyers- markets become inaccessible, policy becomes increasingly important, and choices shrink.

Executive Summary and Key Figures

If you missed the May 4th Presentation you can watch it here.

State of Dallas Housing 2016 looks back at a year in which lawsuits, planning processes, zoning questions and construction galore, although specifically in multi-family rental development, drove housing policy to the forefront of public discourse. The two most significant outcomes were conceptual: that housing must be thought about in terms of neighborhoods, and that affordable housing needs to be included in high opportunity neighborhoods. In order to realize these concepts, Dallas will need to proactively provide new housing products, funding models, and policies- and will need meaningful cross-sector collaboration. Whatever is implemented must also be rooted in serving people, and providing justice and opportunity. This annual report will better equip citizens, housing organizations, and public agencies to be reflective and proactive about building such a city, by tracking changes in demographics, housing markets, neighborhood conditions, and barriers to credit access.

Many of the findings of State of Housing are not new, nor will they be surprising to the civically active. What is unique about this report is the variety of analyses in one place that track market and justice-based metrics to evaluate the shifting landscape of economic activity and social equity from year to year. In the interest of developing highly-accessible, mixed-income neighborhoods in the city, this report creates a baseline by which success can be measured, neighborhood-level change tracked, and action taken. There are other market studies published quarterly or yearly, and other studies about neighborhood conditions, but rarely are the two combined for the public interest.

In this report, housing affordability differs from common notions of affordable housing. While high quality low-income housing and public subsidy are topics of interest, this report is also concerned with neighborhood conditions and middle income housing opportunities. In particular, State of Housing 2016 focuses on homeownership, an area that the city has explicitly stated it hopes to grow.

While other studies and reports have analyzed and visualized aspects included here, State of Housing 2016 is unique in its combination of market and justice based analysis. By following demand, Dallas can invest more efficiently in housing affordability and neighborhood revitalization. By focusing on areas of high opportunity and abundant amenities, Dallas can more effectively achieve bilateral integration. This report provides methods for accomplishing both of these goals.

The report is broken into four major sections:

- Demographics and Economy

- Market for Homeownership

- Barriers to Homeownership

- Opportunities and Solutions

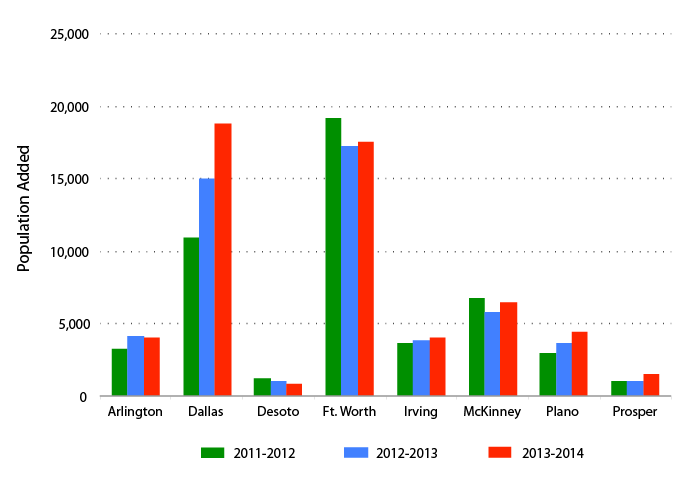

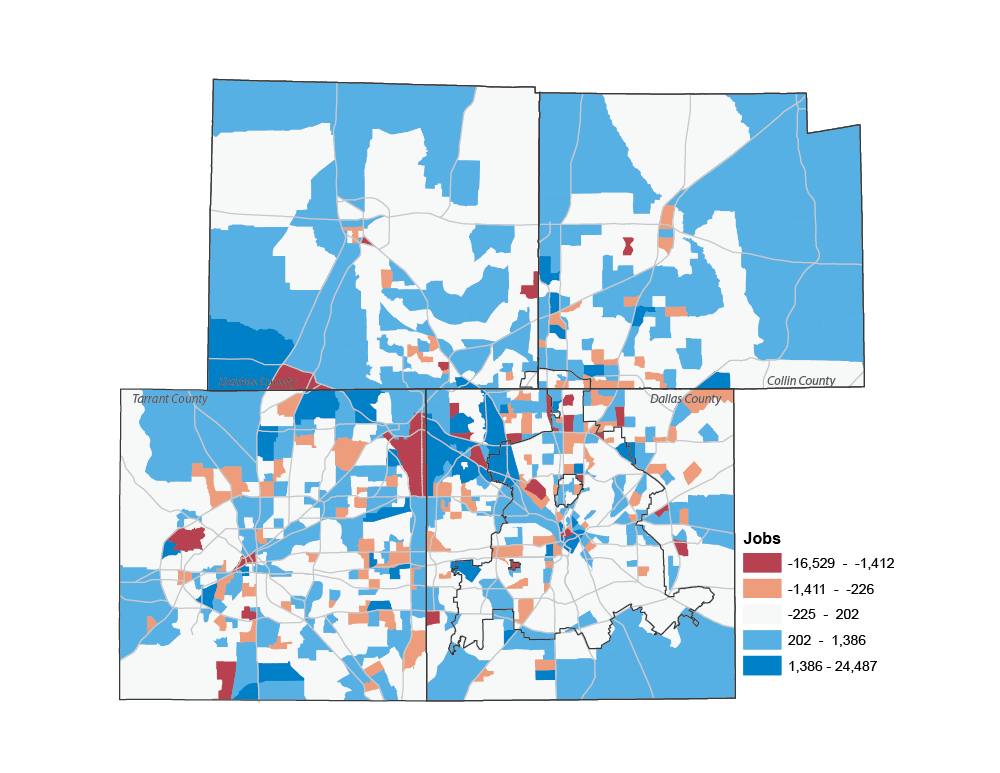

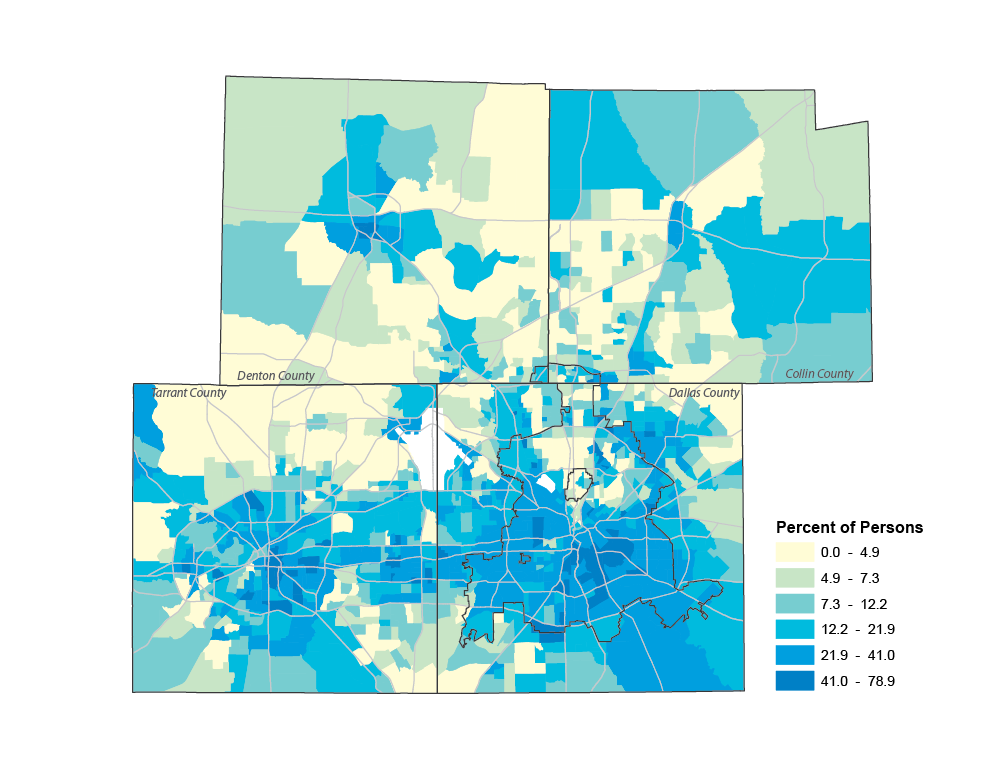

Demographics and Economy give a brief overview of the shifts in population and density, income and poverty, and jobs and job access to set baseline and identify trends about where people live and work and their economic circumstances.

- Dallas’s population growth has increased each of the past three years and its growth rate has become more competitive with other cities in the region.

- Jobs growth in Dallas has not spread significantly to the south towards those who need them.

- Across each of the major metrics here, poverty, income, and jobs, a “barbell” economy is apparent: highly polarized with little in the middle.

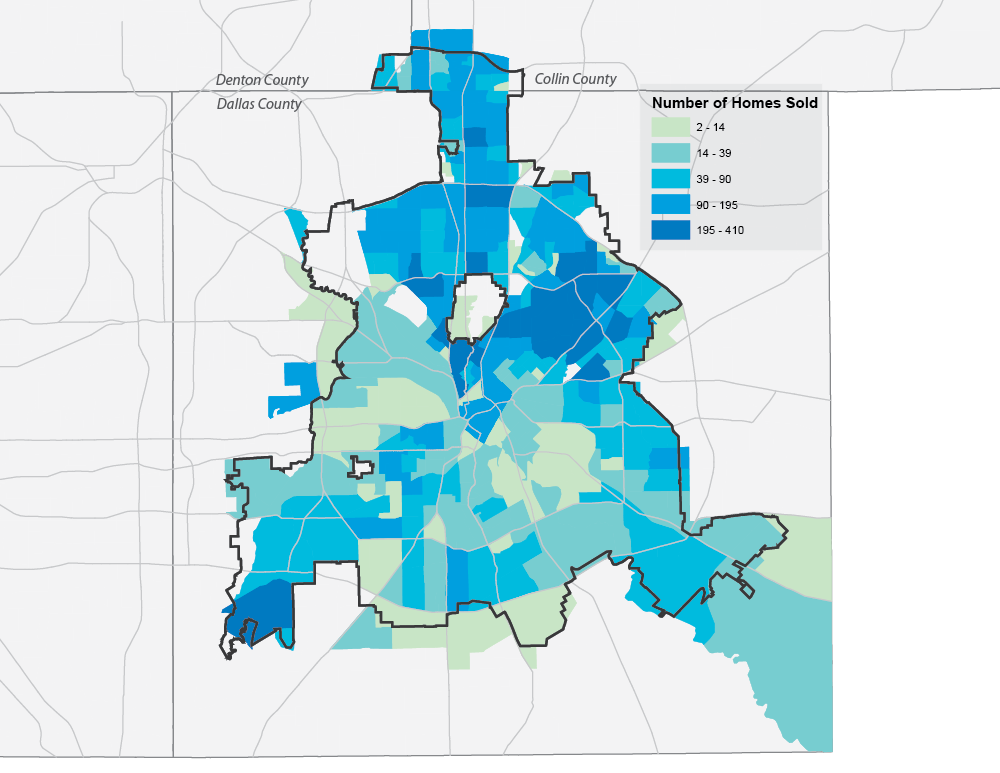

Against that backdrop, the Market for Homeownership chapter investigates housing markets in North Texas at the city and neighborhood level, emphasizing three basic questions: Who is buying homes? Where are they buying homes? and What are the characteristics of the homes people are buying?

- The barbell condition identified in previous chapter carries over into study of the homeownership market. There have been modest gains in demand for housing in southern Dallas, particularly along I-30, adjacent the Central Business District, and at the city’s southern border.

- The neighborhood’s experiencing the most significant demand are from just east of White Rock Lake all the way to Central Expressway, and from Uptown through Oak Lawn towards Love Field Airport. Sales prices have increased dramatically in large areas of Southern Dallas, but are being raised from a very low floor.

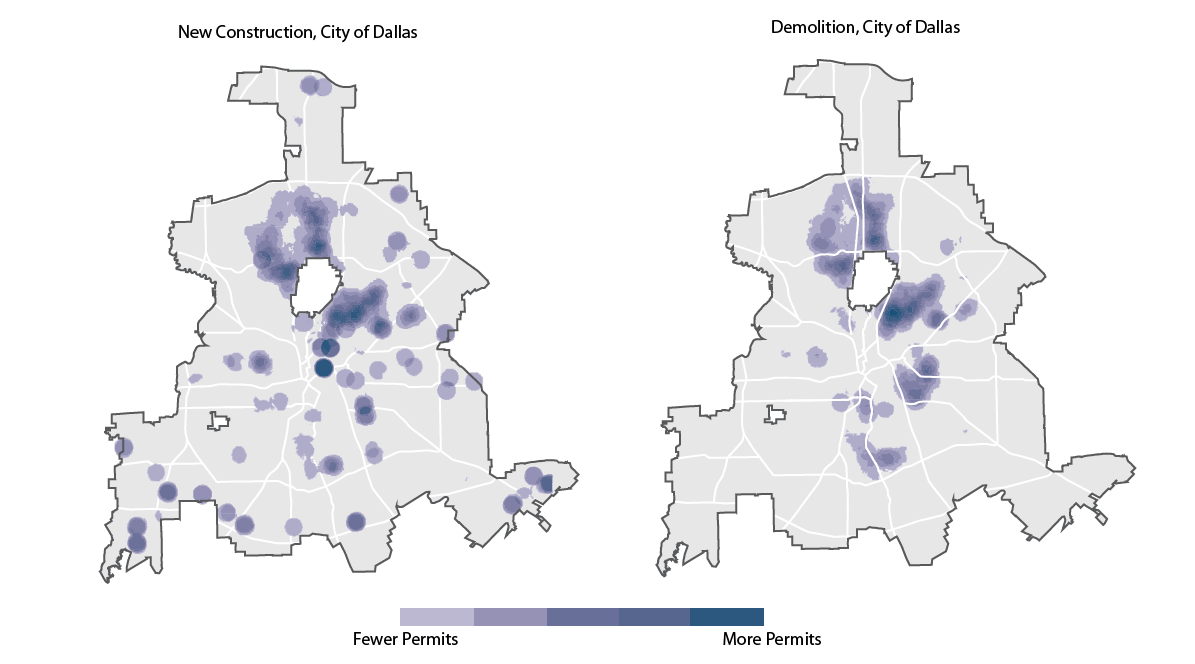

- Building permits indicate that most new building in the city for homeownership is for replacement housing in wealthy neighborhoods, not revitalization.

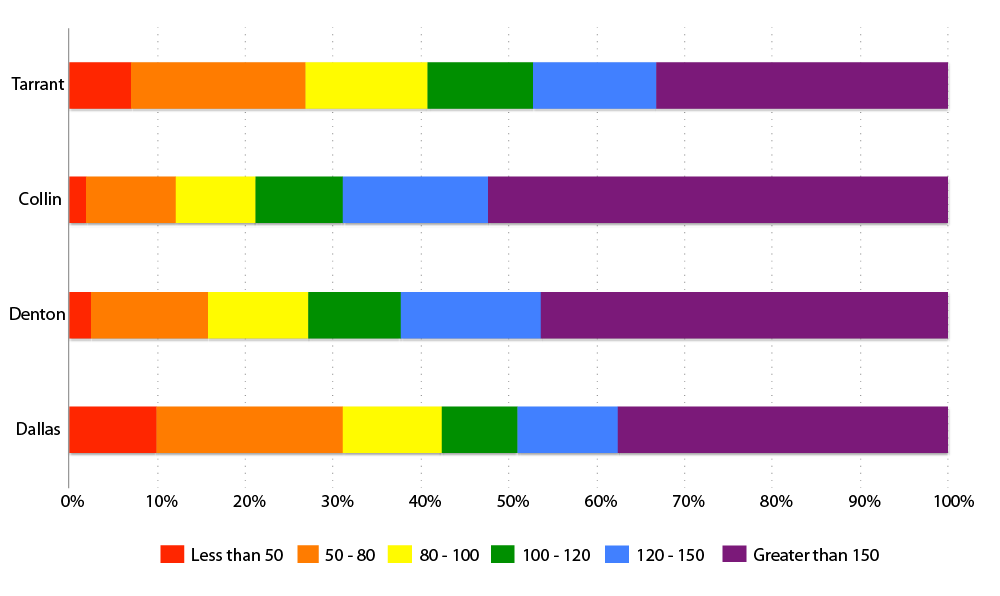

- Mortgage applicants for Dallas are poorer, and less white than elsewhere in North Texas

- Dallas has a lower proportion of homeowners than other cities in North Texas and particularly lacks young homeowners

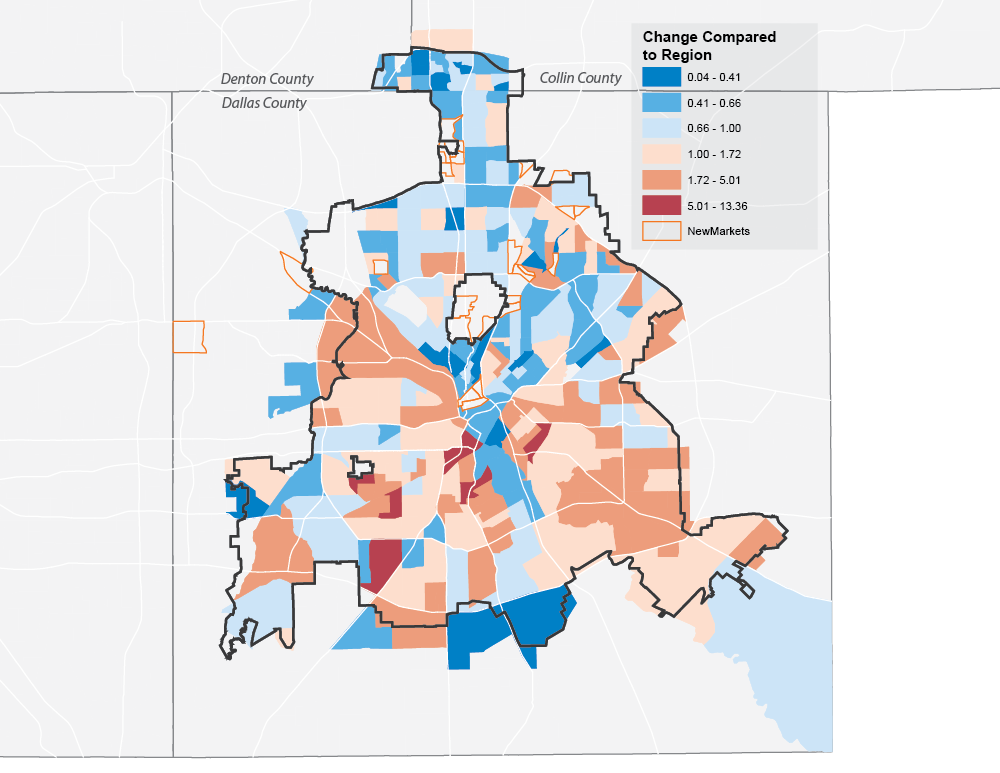

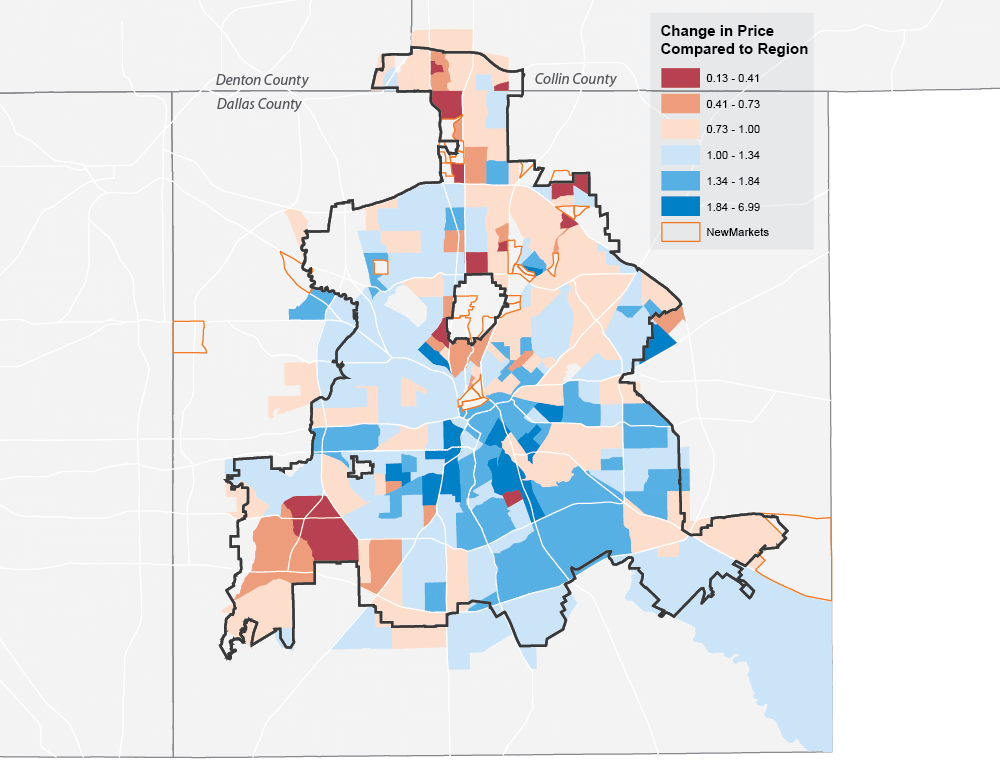

- Three Market Heat analyses were conducted- 2015, Trend (2011-15), and Combined - using three metrics for demand- Days on Market, Number of Sales, Sales Price- comparing individual tracts to the region

- 2015 Market Heat is predictable, showing heavy demand for housing between Central Expressway and White Rock Lake, and in Uptown and minimal demand in East Oak Cliff, South Dallas/Fair Park and Pleasant Grove

- The Market Heat Trend, however, shows demand growing in North Oak Cliff, Deep Ellum, the Cedars, and Old East Dallas. There is indication of increasing market activity further into South Dallas/Fair Park, trickling westward and southward from North Oak Cliff, and moving towards Love Field, among other pockets of increasing demand.

Market Heat, 2015

Market Heat, Trend, 2010-2015

Market Heat, Combined

Barriers for Homeownership outlines what prevents Dallas from competing more comprehensively for the region’s significant housing demand, particularly among middle income households, and also what prevents homebuyers who are interested in Dallas from purchasing a home there.

- Market demand, more so within Dallas than other North Texas cities, appears to correlate with segregation, school quality, poverty, and educational attainment

- Areas with low demand also tend to have a higher number of rental households, vacant homes, and vacant residential land

- Low-to-moderate income homebuyers are becoming a smaller portion of the mortgage applicant pool and having an increasingly difficult time getting approved.

- Middle-income homebuyers are less likely to be approved for a mortgage in Dallas than other North Texas counties

- Black and Hispanic homebuyers make up a disproportionately small percent of mortgage applicants and high percent of mortgage denials across North Texas

- It is more difficult for poor people to obtain credit in heavily white neighborhoods, and for all wealth classes to obtain credit in heavily minority neighborhoods

Percent of Mortgage Applicants Denied by Applicant Income, 2014 (HMDA)

Homes in Poor, Very Poor, or Unsound Condition, Dallas, 2015 (DCAD)

Mortgage Denials, Income, Race, and Neighborhood, Dallas County, 2014 (HMDA)

Tracking housing metrics and planning for neighborhood change become powerful tools only when they are followed by decision-making and implementation. Creating a city where healthy housing activity occurs in both north and south, homeownership is available in areas of opportunity to people of color and modest means, and new amenities don’t mean that old neighbors must leave, requires action. This report goes as far as to identify vacant, mostly publicly-owned sites across the city where development can be curated towards accomplishing these goals.

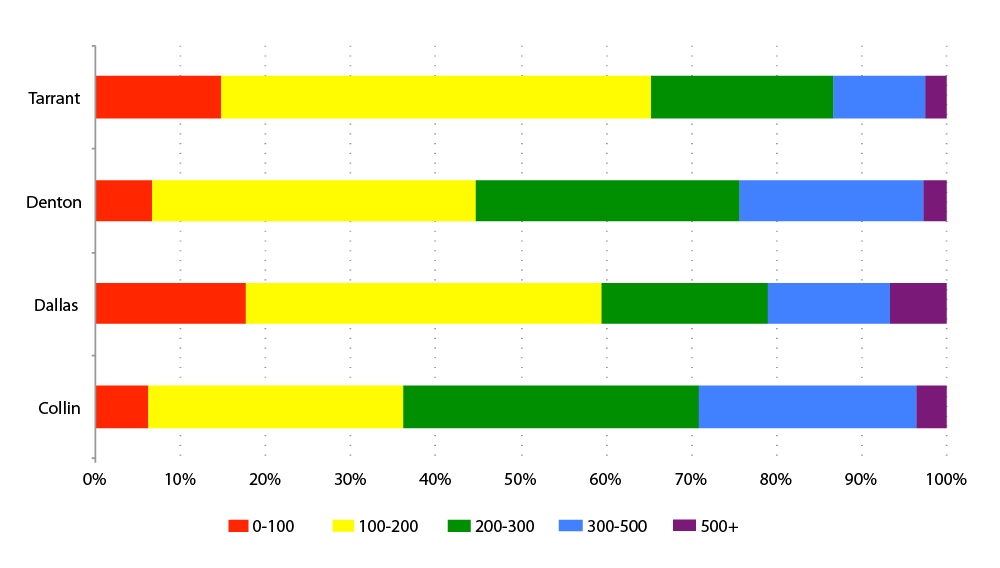

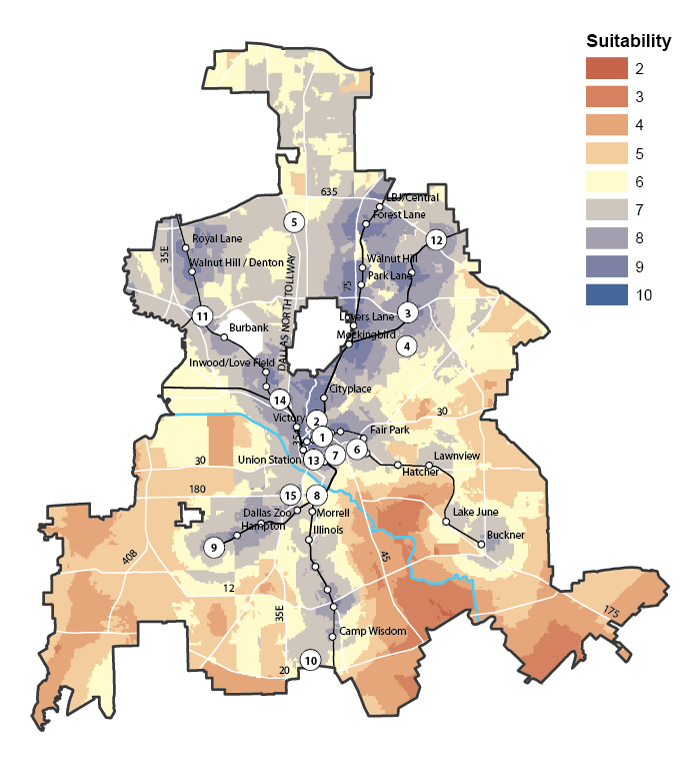

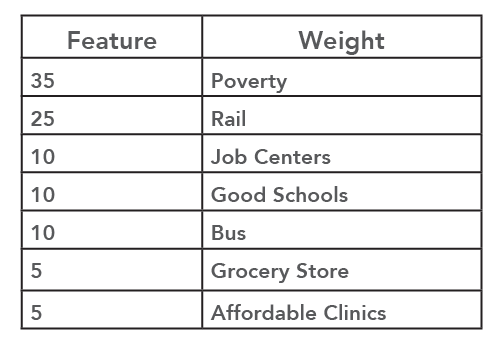

The conclusions from this analysis are synthesized and then applied alongside the goals and suggestions from Neighborhoods Plus, to identify actual locations where housing could sited to begin to resolve the challenges and opportunities outlined in the report. A suitability analysis scores the total area of the city based on proximity or access to seven features: Job centers (defined as blocks with 1,000 or more jobs); Grocery stores, bus stops, light rail stations, good schools (rated as B- or above by Children at Risk), affordable health clinics, and poverty.

Areas closer to each feature get a higher score, resulting in seven scores for any area of the city. Each of the seven features is given a weight, based on its influence on a location’s suitability for low-to-moderate income housing. Being in a low poverty area was given the most influence, followed by access to rail. Overlaying each weighted feature results in a composite suitability score.

The suitability analysis is then filtered with the Market Heat analysis, and other attributes identified as assets for housing affordability by Neighborhood Plus such as publicly owned land, or where more urban zoning (townhome or duplex) currently exists or would be appropriate. Then, sixteen sites are profiled, categorized into four types of intervention:

- Integration: Site is located in or near high-opportunity and where affordable housing is scarce- Housing here should be geared towards lower income (50-80% AMI)

- Preservation: Site is located in an area of increasing value where affordability is or may become threatened. Housing here should be geared towards lower income (50-80% AMI)

- Activation: Site has depressed market that may not have adequate demand for housing now, but has significant upside where additional groundwork investment may make it market ready. Housing here should be geared towards lower and middle income (50-120% AMI)

- Future: Site is significant in size and deserves extensive planning and should be thought of as opportunities for the city to plan for model mixed-income neighborhoods. Housing here should be geared towards the full range of incomes.

![[bc]](http://images.squarespace-cdn.com/content/v1/5248ebd5e4b0240948a6ceff/1412268209242-TTW0GOFNZPDW9PV7QFXD/bcW_square+big.jpg?format=1000w)